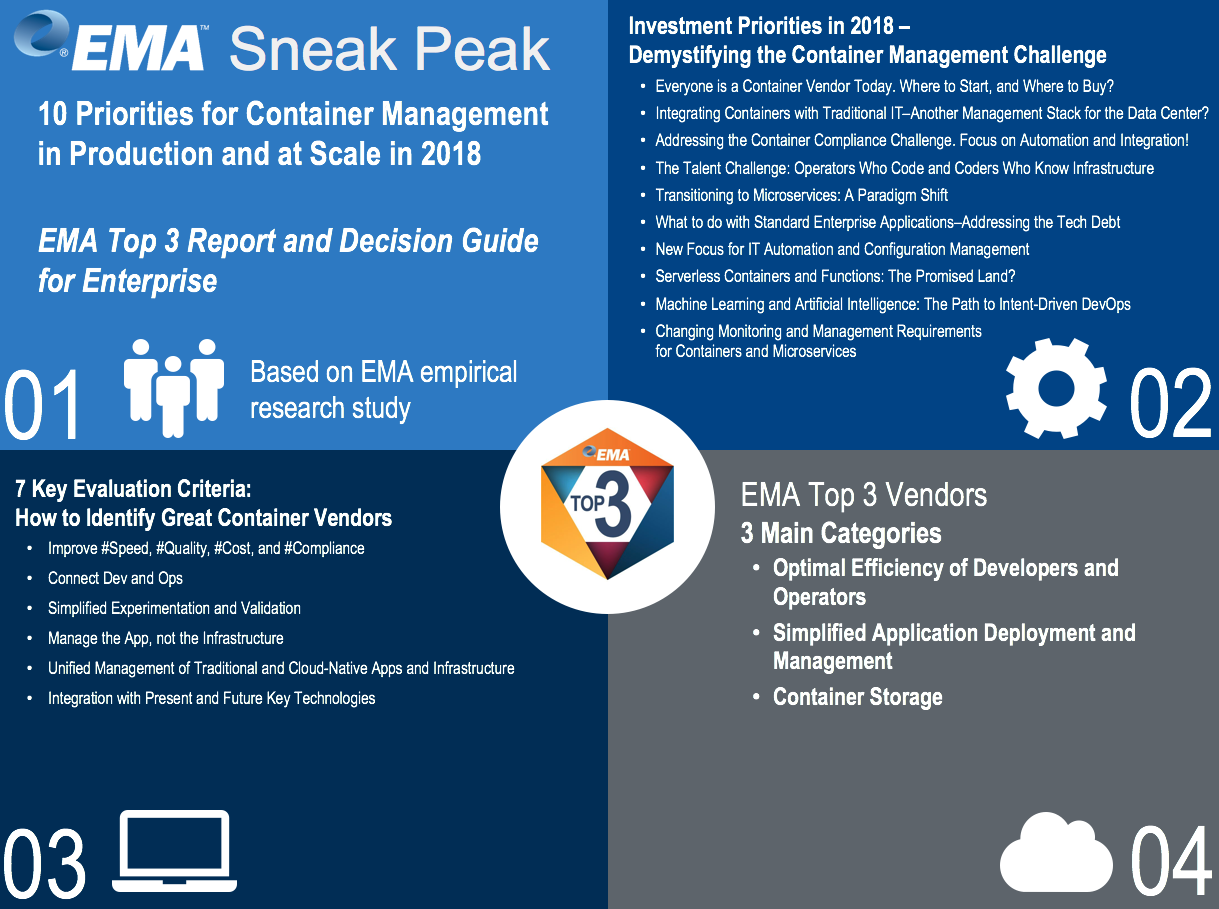

Here's the Sneak Peak to the EMA Container Management in Production and at Scale research project that so many of you have been asking about over the previous 2 months.

Click here for the report homepage with constantly refreshed content.

Based on the questions I received so far, I created a very brief Q&A below the image.

Q&A for this Research

What is the publication date: Mid Q1, 2018

What is the empirical basis: Survey of approximately 300 NORAM enterprises with 300 or more employees.

How do you select the EMA Top 3 vendors: EMA selects vendors that best fit the empirically identified key pain points. See infographic and blog post showing the decision process.

How do you know that a vendor fits the determined key pain points: We combine information from numerous briefings, demos, customer conversations, and documentation materials.

Is an EMA Top 3 selection an endorsement of the respective vendors: No, the Top 3 selection is there to 'guide the eye' of enterprises looking for container and DevOps related solutions. EMA Top 3 vendors bring solutions to the table that EMA deems innovative and relevant to customer requirements.

Are vendors able to influence the results of this research: No, vendors learn about this research upon completion and therefore have no influence in regards to their Top 3 selection.

Why is the EMA Top 3 one of our trademark reports: Because it relies on the practical experience of our analysts in combination with deep empirical (quantitative) research.

How is the EMA Top 3 different from a Radar Report or an MQ: 1) It is based on empirical data of a large n study. 2) It looks for innovative solutions that address specific relevant customer pain points and challenges. 3) The Top 3 is a research report first and foremost and a vendor examination second. Watch the 5 minute EMA Top 3 intro video.

SaveSave

SaveSave

SaveSave

SaveSave

SaveSave

SaveSave

SaveSaveSaveSave

SaveSave